The Ultimate Guide to Forex Trading Sites: Tips, Tricks, and Best Practices

In the ever-evolving world of financial trading, forex trading sites Forex Brokers in Vietnam have become a focal point for traders looking to capitalize on the fluctuations of currency values. With advancements in technology and an increasing number of platforms available, choosing the right Forex trading site can be overwhelming. This guide aims to simplify the decision-making process by providing an overview of important considerations, features to look for, and additional resources to enhance your trading experience.

Understanding Forex Trading

Forex, short for foreign exchange, involves the buying and selling of currency pairs in a decentralized market. Unlike traditional stock markets, the Forex market operates 24 hours a day, five days a week, providing ample opportunities for traders worldwide. At the core of Forex trading is the ability to profit from fluctuations in exchange rates. Traders utilize various strategies and tools to speculate on price movements, making it essential to choose an appropriate trading platform.

Key Features of Forex Trading Sites

When evaluating Forex trading sites, several key features stand out. Understanding these features can help traders make informed decisions when selecting a broker:

- Regulation: Always choose a regulated broker to ensure your funds are protected and that the broker adheres to industry standards.

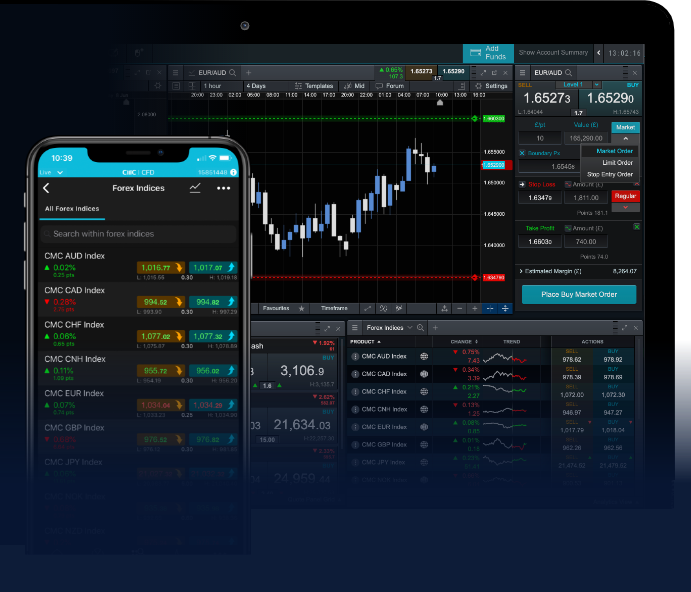

- Trading Platform: The trading interface should be intuitive and user-friendly. Some popular platforms include MetaTrader 4 & 5, cTrader, and proprietary platforms.

- Fees and Spreads: Analyze the commission and spread costs associated with trades. Low fees are critical for maximizing profits.

- Leverage: Different brokers offer varying levels of leverage. While high leverage can amplify profits, it also increases risk.

- Customer Support: Reliable customer service is crucial for resolving issues promptly and efficiently.

- Educational Resources: Quality brokers often provide educational materials, webinars, and tutorials to assist traders in honing their skills.

Types of Forex Trading Strategies

Forex trading can be approached through various strategies tailored to individual trader preferences and risk tolerance. Below are some of the most common strategies:

- Day Trading: This strategy involves making multiple trades within a single day, closing all positions before the market closes to avoid overnight risks.

- Scalping: Scalpers aim to profit from small price movements by executing frequent trades throughout the day, often holding positions for just a few minutes.

- Swing Trading: This strategy focuses on capturing short- to medium-term price moves. Traders typically hold positions for several days or weeks.

- Position Trading: Position traders take a long-term approach, holding trades for weeks, months, or even years, based on fundamental analysis.

The Importance of Technical and Fundamental Analysis

To succeed in Forex trading, understanding technical and fundamental analysis is vital.

Technical Analysis:

Technical analysis involves studying past price movements through charts and indicators to forecast future price trends. Traders use tools such as moving averages, support and resistance levels, and various chart patterns to make informed decisions.

Fundamental Analysis:

Fundamental analysis focuses on economic indicators, news events, and geopolitical factors that impact currency values. Economic reports, such as GDP growth, employment numbers, and inflation rates, can significantly influence Forex markets.

Risk Management in Forex Trading

Effective risk management is essential for any trader looking to navigate the volatile Forex market. Here are some essential risk management practices:

- Stop-Loss Orders: Use stop-loss orders to automatically close a position when it reaches a certain loss level, helping to limit potential losses.

- Position Sizing: Determine the size of each trade based on your total trading capital and risk tolerance to minimize potential impacts on your account.

- Diversification: Avoid putting all your eggs in one basket by diversifying your trading portfolio across various currency pairs.

- Keep Emotions in Check: Stay disciplined and avoid making impulsive decisions driven by emotions, which can lead to detrimental trading outcomes.

Choosing the Right Forex Trading Site

With countless Forex trading sites available, selecting the right one can make a substantial difference in your trading success. Here are steps to take when choosing the best Forex trading site:

- Research Broker Regulation: Verify the regulatory status of the broker to ensure it follows all necessary compliance measures.

- Read Reviews: Check online reviews from other traders and industry experts to gauge the broker's reputation and reliability.

- Test the Trading Platform: Utilize demo accounts to test the broker’s platform before committing real funds.

- Start with a Small Investment: Consider starting with a small investment to get familiar with the trading environment and the broker's offerings.

Conclusion

Forex trading sites offer traders a gateway to the dynamic world of currency trading. By understanding key features, strategies, and risk management tactics, traders can enhance their chances of success in this fast-paced market. Whether you are a beginner or an experienced trader, continuous learning and adaptation to market conditions remain crucial to achieving your financial goals. Always remember, the right Forex trading site can significantly impact your trading journey, so take the time to choose wisely.